Get Started

Compare 80+ lenders in under 2 minutes

Loan AmountThis won't affect your credit score

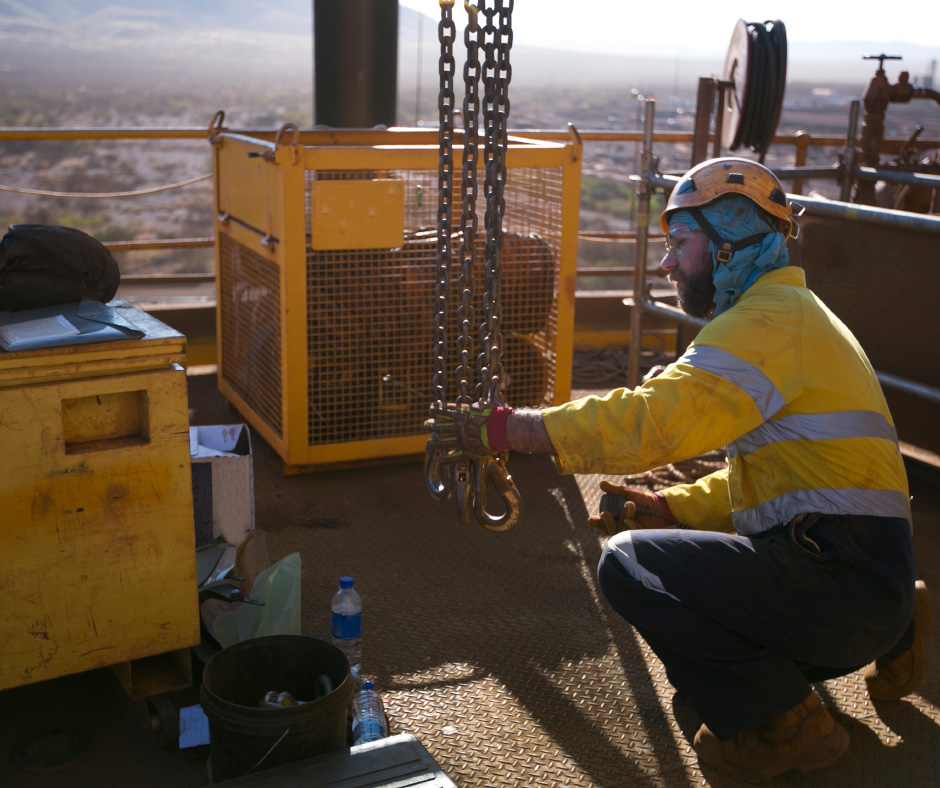

Crane Equipment Loan | Business Finance

An investment in lifting equipment, whether a mini crawler, a truck-mounted, all terrain or a top of the range tower model, is a major acquisition and one that companies expect to deliver a return. We assist operators to improve their ROI with lower interest rates and more affordable funding for all types of lift machinery and equipment. With acute financial acumen, huge lending market coverage and leverage with key lenders, we strategically source and structure solutions to support companies achieve their objectives.

This won't affect your credit score

Find the Best Interest Rates - Compare and Save Now

Compare Business.Finance Crane Loan Interest Rates

Rates vary across the types of credit facilities and across the lending market. With our experience in the heavy equipment sector and our smart tech resources and leverage, we have the capabilities to secure lower rates. Lower rates provide a firm foundation for our brokers to structure a cost-effective and workable outcome for each individual client. Rates also vary for individual applicants. Contact us for the lower rates we can achieve for you and use our displayed rates as a guide for budgeting and comparison.

| Loan Product | Interest Rate | Monthly Repayment |

| {{Loan Product}} | {{From - Advertised Rate}} {{Rate Type}} |

${{Payment Amount}} Monthly |

Disclaimer: This calculator comparison chart is provided for general reference purposes only. It is not in any way intended as a loan application, it is not a quote for finance or any indication that an application has been received or approved. The repayments quoted may not include all the fees and charges that may be applicable. The interest rates and the repayments displayed do not account for any conditions pertaining to your individual loan application. Therefore the interest rate and repayment you may be offered may vary from the amount shown.

Today's best rate

Finance Equipment From

4.99 % Fixed

* The interest rate is calculated on a secured loan for commercial use, effective 27/11/2025 and subject to change. Warning: the interest rate is only true for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts may result in a different interest rate.

Today's best rate

Finance Equipment From

4.99 % Fixed

* The interest rate is calculated on a secured loan for commercial use, effective 27/11/2025 and subject to change. Warning: the interest rate is only true for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts may result in a different interest rate.

Utilise Our Calculator for Financing Estimates

Use a Calculator for Planning Loans for Cranes

To prepare budgets for new lifting equipment purchases, to compare makes and models and credit types, use our hand online calculator. Or give us a call for a quote and fast approval.

Get Expert Guidance Today

How to Use Our Specialist Broker Services for Crane Finance

Accessing our services is direct and using our services is straightforward and streamlined. No referral is needed, and all types of commercial entities are welcome. Just make the call and you will be assigned one of brokers with specific expertise in sourcing lifting equipment funding. Our brokers are sharp, they know financials and we stay current with the latest ATO rulings so we can structure solutions to deliver optimum tax benefits for clients.

Once we have your brief of the equipment you are purchasing and the objectives you are seeking to achieve with the funding, we get the process underway. Connecting with the lender that best suits your profile and negotiating to achieve the lowest interest rate quote and approval. On acceptance of our quote, we proceed with fine-tuning the terms and condition and processing the application and assisting with settlement.

With the growth and diversity of the commercial lending sector, it can become increasingly more difficult for operators to source exactly the right lender and without leverage, extremely difficult to negotiate. We ease those difficulties with our hands-on, thorough and detailed approach.

- Australian based, owned and operated.

- Access to clients across all parts of Australia.

- Over 20 years of experience, specialist crane and heavy equipment lending expertise.

- Smart tech plus sharp finance acumen and the latest intel to deliver targeted solutions.

Crane Financing Options with Expert Lender Connections

Fast Connect with the Right Crane Loan Lenders

Interest rates, application criteria, funding terms and conditions and approval guidelines can vary from lender to lender. We facilitate a fast connect for clients with lenders that are specifically suited to their profile and the equipment being acquired. We have accreditations with over 80 lenders, giving our brokers a huge market coverage to ensure we do have the right lender for each client.

Our accreditations include Australia’s largest and many smaller banks as well as a diverse group of non-bank lenders. Many of which specialise in particular fields such as construction equipment, mining machinery and freight handling assets. We use our connections to secure the lowest rates and most workable solutions for clients.

- Connect with more than 80 lenders.

- Specialist crane finance lenders.

- Australia-wide access for all types of operations, companies and organisations.

Ideal Financing Solution for Your Crane Acquisition

Select the Right Type of Finance for Cranes

There are four main types of asset acquisition credit facilities, each with varying features and benefits and suitability to different entities and objectives. We offer the complete portfolio and clients advise which option they would like us to source on their behalf. The variations in financing facilities relate significantly to accounting measures. As such, we recommend that our clients have a discussion with their accountant as to which will deliver the preferred outcome for their set-up.

These facilities suit both new and used lift equipment. We ensure the interest rate and term are fixed to deliver a fixed repayment schedule. Balloon, residual and buyback options are available.

- Chattel Mortgage for Cranes

- Crane Leasing

- Commercial Hire Purchase Crane Finance

- Rent-to-Own Crane Loans.

- New and Used Crane Loans.

- Fixed rates, fixed terms up to 7 years, fixed repayments

Secure Fast Approval for Crane Finance

Get Crane Finance Solutions for All Makes, Models, Industries

Funding solutions are available for all lift equipment users across all industry sectors. Freight movement, building and construction, mining, materials handling, utilities installation and maintenance, telecommunications, rescue services, tree services, land management, property maintenance and specialist applications.

- Finance for cranes, libs and lifting equipment

- Loans for portable cranes, scissor lifts and pick and carry models.

- Affordable financing for telescopic, crawler, rough and all terrain and hydraulic truck cranes.

- Strategically structured finance for truck-mounted, truck loading and tower cranes.

- Loans for Caterpillar, Liebherr, Zoomlion, Demag, Franna, Grove, Kato cranes

FAQs

Crane Loans

The choice of funding types for lifting equipment are Rent-to-Own, CHP, Leasing and Chattel Mortgage. Each has varying features which will suit different company set-ups and objectives. The best option is the one which best suits the accounting approach of the operations.

Interest rates are different for different credit facilities, can vary from lender to lender and for individual applicants. For a specific interest rate offer, operators can request a quote.

Repayments on Lease and Rent-to-Own are considered a business expense and are tax deductible. Repayments on CHP and Chattel Mortgage are not deductible. These forms of funding provide a tax deduction through depreciation of the asset.

Buyback relates to Rent-to-Own funding. It is the amount payable at the end of the term for the borrower to take full ownership of the goods from the lender.

Used and new goods can both be acquired with the choice of Leasing, CHP, Chattel Mortgage and Rent-to-Own. The interest rate for used goods can be different from the rate offered for new goods. Lenders will assess the age and condition of goods and apply terms and conditions based on that assessment.

Prior to requesting a quote, buyers can use an online credit calculator to obtain rough estimates. These are only estimates and any quote may differ from the calculator results.

Terms of up to 7 years are typical for heavy equipment funding but will be subject to lender guidelines.

The same types of credit facilities are used for all makes and models of lift equipment. The specific interest rate and conditions may vary with different types of equipment, subject to lender guidelines.

When starting a new company, operators may not have all the documentation to meet the approval criteria for commercial credit applications. A low doc or no doc option may be considered. These can be sourced from specialist lenders and brokers.

Commercial credit products enable the equipment being acquired to be the security against the funding. Lenders may request additional security be provided by certain applicants. This will be based on individual lender guidelines.

Our Lenders

Trusted by 60+ lenders Australia-wide